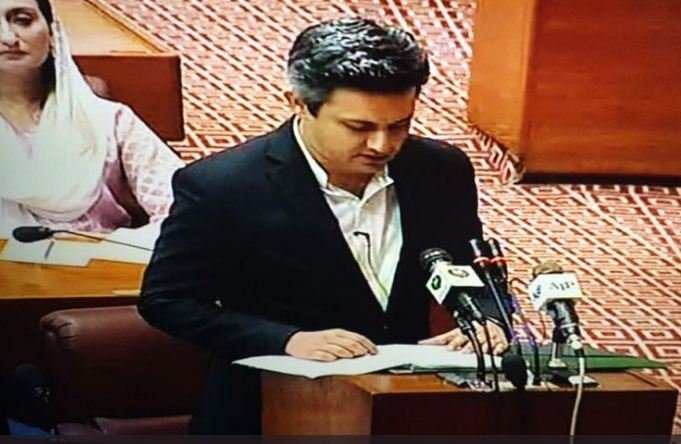

Minister of State for Revenue Hammad Azhar unveiled Pakistan’s Budget 2019-20 today 11th June 2019.

Here are some of the Key Pointers of the presented Pakistan’s Budget 2019:-

- Pakistan Federal Cabinet voluntarily agreed to reduction in 10% salaries

- Government Employees Salaries: 10% Increase in Grade 1-16, 5% Increase in Grade 17-20, No Increase in Grade 21-22, 10% Increase in Pension Holders.

- Budget on Education has been increased from PKR 35bn to PKR 57bn.

- Persons employing fresh graduates (Graduated after July 1, 2017 from HEC recognized institutes/universities) would be given TAX CREDIT equal to the “amount of Annual Salary” paid to such graduates.

- Govt allocates Rs29047 mln for Higher Education sector.

- Sales tax on restaurants and bakeries reduced from 7.5 to 5%.

- PKR 7579.200 million for various schemes of Climate Change allocated.

- PKR 7,407mn allocated for Science Technology Research division.

- “Kamyaab Jawaan” program to offer PKR 100bn loans for new businesses.

- FED on cement increased from PKR 1.5/kg (PKR 75/bag) to PKR 2/kg (PKR 100/bag).

- Federal Excise Duty on cigarettes increased from PKR 4500 to PKR 5200 per 1000 sticks.

- Taxable income for salaried persons has been set at PKR 600,000/annum. For the non-salaried people, it is set at PKR 400,000/annum.

- Tax to GDP ratio to be increased to 12.6pc.

- Tax on dividends paid by power generation companies increased to 15% from current rate of 7.5%.

- 17% federal excise duty imposed on branded cooking oil.

- 13% federal excise duty imposed on cold drinks.

- Food items supplied to bakeries and restaurants will be taxed at 4.5%.

- Sales tax on sugar increased from 8% to 17%.

- 3% duty waived on 19 basic medical products.

- Corporate tax rate fixed at 29% for next two years.

- 5% duty on LNG.

- 10% tax will be imposed on milk, cream, and flavored milk items.

- Non-Filers can now purchase property.

- Tax on immovable property decreased from 2% to 1%.

- Govt would transfer Rs3,255 billion to provinces under the NFC award.

- GST maintained at 17%.

- 3% VAT reduction on mobile phone imports.

- Minimum monthly salary set at PKR 17,500/-

- PKR 516 mln allocated for digitization of production & transmission infrastructure of Pakistan Television and Radio Pakistan.

- Sales tax of 17% restored for five export-oriented sectors.

- PKR 701 billion allocated for development (read roads, schools, hospitals, power plants etc).

- Sales tax on export of PVC and PMC to Afghanistan and Central Asian Republics reduced to 0%.

- Government expenditure decreased from PKR 460bn to PKR 437bn.

- PKR 15 bn allocated for Mohamand Dam.

- PKR 20bn allocated for Daimer Bhasha Dam.

- PKR 43.5 billion allocated for the development of Karachi.

- PKR 200 billion subsidy on electricity.

Sam Irfan believes in the power of clear, straightforward writing. His blog posts tackle everyday topics with relatable insights and easy-to-follow advice. With a conversational style, he makes complex subjects feel understandable. He’s dedicated to sharing knowledge and empowering readers to take action. Find his latest posts on trending in social.